Ever feel like you’re staring at a confusing chart and wish you knew what it meant? Maybe you’ve heard about technical analysis, the secret language of the stock market. It helps traders predict where prices might go. But where do you even start learning this skill?

The world of technical analysis books is HUGE! You’ll find tons of books, all promising to teach you how to trade. The problem? Many books use complicated words or leave out important details. Finding the right book can feel like searching for a needle in a haystack. Choosing the wrong one can waste your time and money.

This blog post is your guide. We’ll cut through the confusion and point you toward the best books. You’ll learn which books are easy to understand and which ones offer the most valuable information. Get ready to learn about charts, patterns, and how to make smarter trading decisions. We’ll even help you avoid some common mistakes!

Ready to decode those charts? Let’s dive into the top technical analysis books to help you start your trading journey. We’ll explore some of the most recommended books and what makes them great. So, let’s get started!

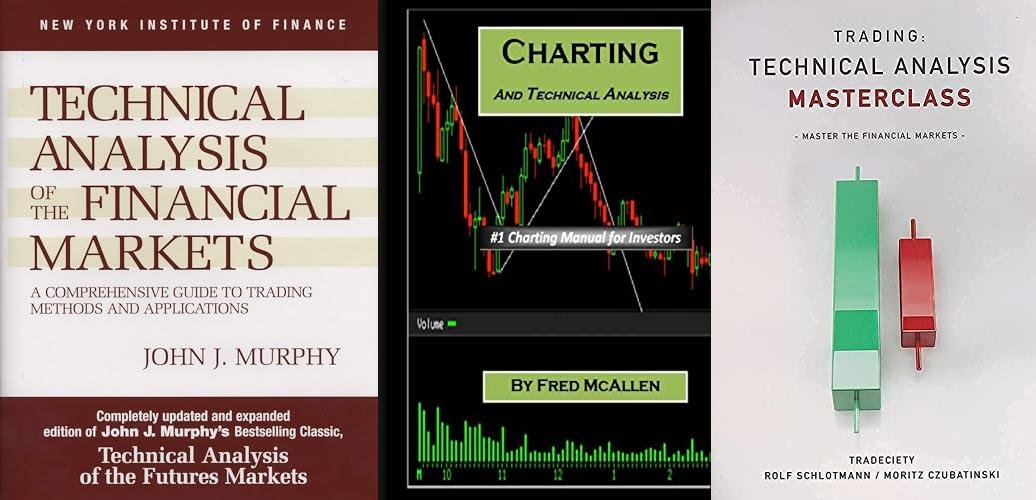

Our Top 5 Technical Analysis Books Recommendations at a Glance

Top 5 Technical Analysis Books Detailed Reviews

1. Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications

Rating: 9.1/10

Dive into the world of finance with “Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications”! This used book is in good condition. It is a must-have for anyone wanting to learn about trading. It will teach you different methods and how to use them. Get ready to understand charts, patterns, and trends!

What We Like:

- The book is a complete guide for traders.

- It covers many different trading methods.

- It explains how to use these methods.

- You can learn about charts and patterns.

- The book is in good condition.

What Could Be Improved:

- It’s a used book, so it might have some wear.

This book is a great resource for new traders. It gives good information about technical analysis. You will learn a lot from it.

2. Charting and Technical Analysis

Rating: 8.8/10

Want to learn about the stock market? This review is for the “Charting and Technical Analysis” product. It helps you understand how the stock market works. It focuses on charting and analyzing stocks. You can use it for stock market trading and investing. This product breaks down complex information into easy-to-understand concepts. It is perfect for beginners interested in technical analysis for stocks.

What We Like:

- It teaches you about charting and technical analysis.

- You learn about stock market trading.

- It helps you analyze the stock market.

- It is made for technical analysis of stocks.

- It covers investing basics.

What Could Be Improved:

- The information can be overwhelming at first.

- It might need more examples for beginners.

Overall, this product is a great starting point for anyone wanting to learn about the stock market. It provides a solid foundation in technical analysis and investing concepts.

3. Trading: Technical Analysis Masterclass: Master the financial markets

Rating: 8.6/10

Ready to dive into the world of trading? The “Trading: Technical Analysis Masterclass: Master the financial markets” book is here to help! It’s written in English and designed to teach you how to understand the financial markets. The book uses high-quality materials, so it should last a long time. Get ready to learn about charts, trends, and strategies to make informed trading decisions!

What We Like:

- It’s written in English, making it easy to understand.

- The book focuses on technical analysis, a key skill for traders.

- The book is made with premium materials.

- It provides a good starting point for learning about financial markets.

What Could Be Improved:

- The book might be difficult for beginners.

- It might not cover all trading strategies in detail.

This book is a great resource for those wanting to learn about technical analysis. If you are new to trading, it will get you started. If you are already trading, you might learn something new!

4. Technical Analysis For Dummies

Rating: 8.6/10

Are you ready to learn about the stock market? “Technical Analysis For Dummies” aims to help you. It is a guide that explains how to read charts and predict market moves. The book simplifies complex ideas. It is made for people who are new to trading. You can learn about trends, patterns, and indicators. These tools can help you make smart investment choices. The book wants to make technical analysis easy to understand.

What We Like:

- The book makes hard topics simple.

- It is good for beginners who are just starting.

- It explains charts and trading terms.

- It provides examples to help you understand.

- It covers a wide range of technical analysis tools.

What Could Be Improved:

- N/A

In conclusion, “Technical Analysis For Dummies” is a helpful book. It explains technical analysis in a clear way. This book is a good starting point for new investors.

5. Study Guide to Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications (New York Institute of Finance S)

Rating: 8.8/10

Dive into the world of finance with the “Study Guide to Technical Analysis of the Financial Markets”! This book, published by Prentice Hall Press, is a deep dive into the world of trading. It explains how to analyze financial markets. It’s a comprehensive guide. It covers different trading methods and how to use them. If you like reading and learning, this book is for you! It’s a perfect guide for anyone who wants to understand the stock market better.

What We Like:

- It’s a complete guide to understanding technical analysis.

- The book is well-written and easy to follow.

- It explains complex topics in a clear way.

- This is a great choice for someone who loves to read.

- You can learn many trading methods.

- It’s great for bookworms.

What Could Be Improved:

- It can be a bit dense for beginners.

- Some examples could be more modern.

Overall, this study guide is a fantastic resource. It is perfect for anyone who wants to learn about technical analysis. This book will help you understand the financial markets.

Become a Chart Master: Your Guide to Technical Analysis Books

So, you want to learn about technical analysis? Awesome! Technical analysis helps you understand the stock market. It uses charts and patterns to predict future prices. This guide will help you pick the best technical analysis books.

Key Features to Look For

Choosing the right book is important. Here are some things to consider:

- Clear Explanations: Does the book explain things in a simple way? You want to understand the concepts, not get lost in complicated jargon.

- Easy-to-Follow Examples: Look for books that use real-world examples. These show you how to apply the ideas.

- Good Charts and Diagrams: Charts are the heart of technical analysis. Make sure the book has clear, easy-to-read charts. They should show different patterns and indicators.

- Up-to-Date Information: The stock market changes. The book should cover modern trading practices.

- Focus on Practical Application: The book should help you use technical analysis in your own trading.

Important Materials Covered

A good technical analysis book will cover these important topics:

- Chart Types: Learn about different chart types. These include line charts, bar charts, and candlestick charts.

- Technical Indicators: Indicators are tools to help you predict price movements. Common indicators include Moving Averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence). The book should explain how to use them.

- Chart Patterns: These are patterns that appear on charts. They can signal a trend change. Examples include head and shoulders, double tops, and triangles.

- Risk Management: No trading is guaranteed. A good book will teach you how to manage risk. It will show you how to protect your money.

- Trading Psychology: Trading can be stressful. The book might help you understand the emotional side of trading.

Factors That Improve or Reduce Quality

Some things make a book better or worse:

- Good:

- Experienced Author: A book by someone with real-world trading experience is a plus.

- Clear Writing Style: The book should be easy to read. It should avoid confusing terms.

- Positive Reviews: See what other readers say. Are they happy with the book?

- Well-Organized Content: The information should be organized logically. This makes it easier to learn.

- Bad:

- Outdated Information: The stock market changes. Old information is not helpful.

- Poorly Drawn Charts: Hard-to-read charts make learning difficult.

- Overly Complex Language: Avoid books that are too difficult to understand.

User Experience and Use Cases

How will you use these books? Here are some ideas:

- Beginner’s Guide: If you are new to trading, start with a beginner’s book. It will teach you the basics.

- Intermediate Level: If you know the basics, look for books that cover more advanced topics.

- Practical Application: Use the book to learn about different trading strategies. Practice them with real-world charts.

- Supplement to Other Resources: Use the book with online courses or trading platforms. This gives you a well-rounded education.

- Reference Guide: Keep the book handy as a reference. You can look up terms or strategies.

Frequently Asked Questions (FAQ)

Q: What is technical analysis?

A: Technical analysis is studying past price movements to predict future price movements of stocks or other assets.

Q: Who is technical analysis for?

A: It is for anyone interested in trading stocks, forex, or other financial instruments.

Q: What are the best types of charts to learn?

A: Start with candlestick charts. They show a lot of information in an easy-to-understand way.

Q: What are technical indicators?

A: Technical indicators are tools that help you analyze charts. They give signals about price trends.

Q: How important is risk management?

A: Risk management is extremely important. It protects your money. It helps you make smart trading decisions.

Q: How do I know if a book is good?

A: Read reviews. See if the author has experience. Check the charts and examples.

Q: Can I learn technical analysis by just reading books?

A: Books are a great start. You should also practice with real charts. Consider taking online courses too.

Q: What are some common chart patterns?

A: Head and shoulders, double tops, triangles, and flags are common patterns.

Q: What is the difference between technical and fundamental analysis?

A: Technical analysis looks at charts. Fundamental analysis looks at a company’s financials and other factors.

Q: Should I trade with real money right away?

A: No, it is best to start with a demo account. Practice trading without risking real money first.

In conclusion, every product has unique features and benefits. We hope this review helps you decide if it meets your needs. An informed choice ensures the best experience.

If you have any questions or feedback, please share them in the comments. Your input helps everyone. Thank you for reading.

Hi, I’m Sean Kernan, the mind behind darkviolet-cobra-206266.hostingersite.com!! As a passionate sports enthusiast, I created this platform to share my experiences and insights about the dynamic world of sports. From in-depth analysis to personal stories, I aim to bring you closer to the game and inspire a deeper love for sports. Join me as we navigate this exciting journey together!